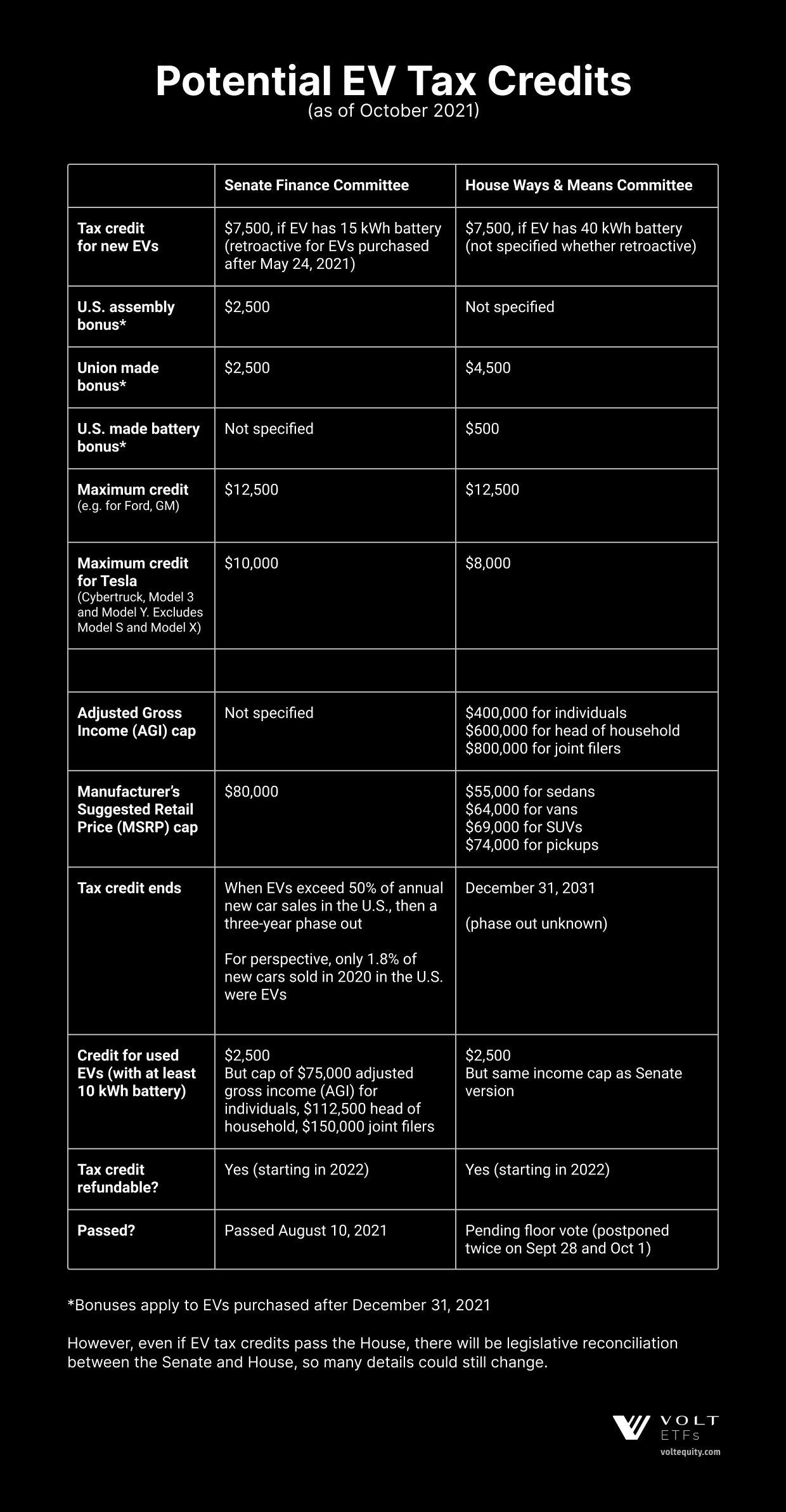

Retroactive Tax Credits 2024 California Income

Retroactive Tax Credits 2024 California Income – The plan temporarily expands access to the child tax credit with retroactive $1,900 for 2024 and $2,000 for 2025 — and a new calculation would expand access. The current calculation for the . If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can .

Retroactive Tax Credits 2024 California Income

Source : www.voltequity.com

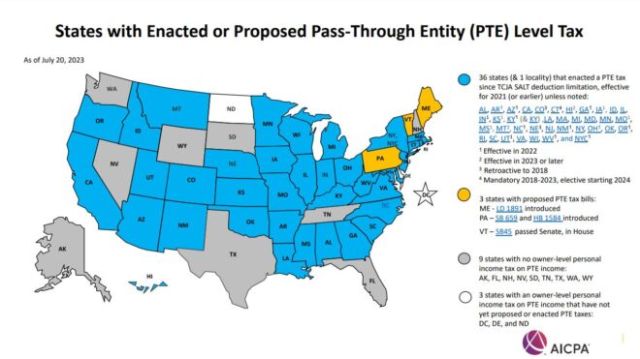

Did you know 36 states have enacted PTE tax laws to enable owners

Source : www.tafttaxinsights.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

ICYMI | Current Developments in California, Florida, Indiana, and

Source : www.cpajournal.com

Retroactive Filing for Employee Retention Tax Credit Is Ongoing

Source : www.shrm.org

Did You Know 36 States Have Enacted PTE Tax Laws To Enable Owners

Source : www.mondaq.com

San Diego Unified school board OKs raises, teachers contract The

Source : www.sandiegouniontribune.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Clean Energy Business Network | Washington D.C. DC

Source : www.facebook.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Retroactive Tax Credits 2024 California Income The Tesla EV Tax Credit: Child tax credits are likely to be expanded thanks to a $78 billion tax agreement between the Democrat-led Senate Finance Committee and the Republican-helmed House Ways and Means Committee. . A new tax bill aims to increase access to the child tax credit for lower-earning families — but it’s much less generous than it was in 2021. .